Why You Can't Escape Buying Car Insurance In Kenya

Buying car insurance in Kenya is a necessity if you want to drive legally. Our Kenyan government has passed several laws and regulations that require drivers to purchase and maintain car insurance. This is done to ensure that all drivers are properly covered in the event of an accident, and it also helps to reduce the cost of car repairs and medical bills. Not buying car insurance in Kenya can result in serious legal consequences, as well as financial penalties. Therefore, drivers need to understand why they can’t escape buying car insurance in Kenya.

Overview of Kenya’s Car Insurance Laws

Like any other country, the Kenyan government requires drivers to have minimum levels of car insurance coverage. The minimum requirements are based on the age of the driver and the type of car they are driving. The minimum car insurance requirements are as follows:

All drivers must have car insurance coverage of minimum Third-party insurance and Third-party liability

Comprehensive car insurance. All drivers must have a minimum level of insurance to legally drive a car in Kenya. Drivers who do not have the required minimum car insurance coverage risk hefty penalties. In Kenya, the Criminal Justice Act of Kenya sets out the penalties for drivers who do not have car insurance.

Benefits of Buying Car Insurance in Kenya

- Protects You in the Event of an Accident – As we mentioned above, not buying car insurance in Kenya can result in hefty penalties. However, purchasing car insurance in Kenya helps to protect you in the event of an accident. You will have coverage for medical expenses, car repairs, and any other costs related to an accident. This is especially important if you plan to drive professionally. If you are a driving instructor, bus driver, or another professional who must drive your vehicle regularly, then you must have insurance.

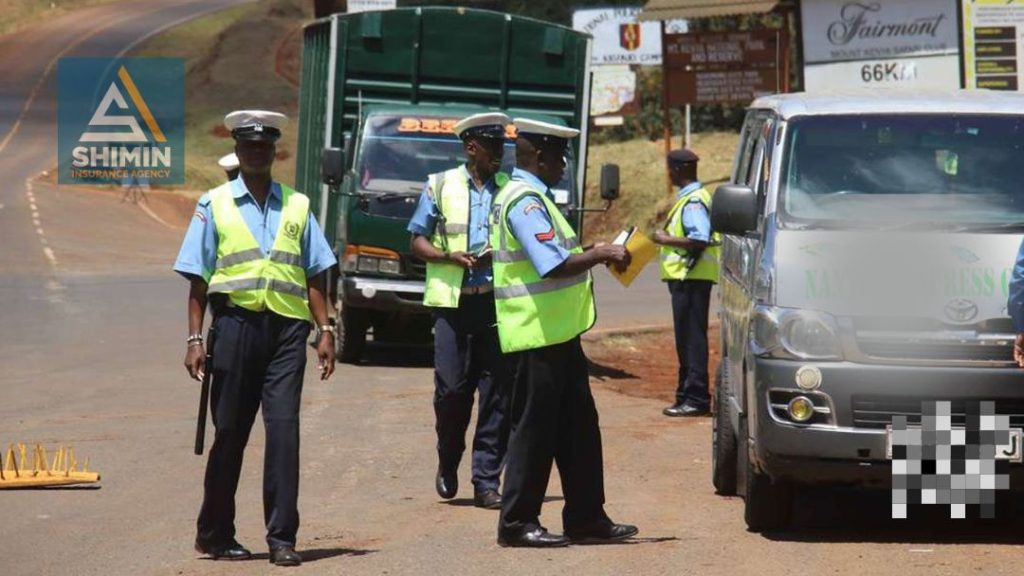

- Empowers Government to Investigate Accidents – Another benefit of buying car insurance in Kenya is that it helps to empower the government to investigate accidents. If another driver does not have adequate car insurance coverage, then the government cannot investigate the accident. In Kenya, the government regulates the transportation sector, including the operation of roadways and the construction of highways. This means that the government can impose penalties on drivers who do not have car insurance in Kenya.

Penalties for Not Buying Car Insurance in Kenya

It is compulsory to insure your vehicle in Kenya. Driving a car without insurance will attract a penalty of Sh10,000 or a jail term. This is simply because the government cannot investigate an accident without adequate car insurance coverage. If you do not have the required car insurance coverage, then the police will simply issue you a fine. – 6-Month Driving Ban – If you are caught not having car insurance in Kenya, then the police can also issue you a six-month driving ban.

If a driver is banned from driving, they will not be able to earn money or support their family while they wait to get their driving privileges back. This means that you will have to find another way to get to work, school, or any other place you need to go.

The Different Types of Car Insurance Available in Kenya

- Third-party property damage coverage – This is the most common form of car insurance in Kenya. It protects you against the cost of repairs and medical bills in the event of an accident.

- Third-party liability coverage- This form of insurance protects you against the financial consequences of an accident. If another driver causes an accident while they are under the influence of alcohol, or if they have a blood-alcohol level over the legal limit, then they will be liable for any damages.

- Comprehensive coverage – This coverage protects you against the cost of damage to your car. If another car crashes into yours, then comprehensive coverage will cover the cost of repairs.

How to Choose the Right Car Insurance for You

Research the cost of different types of car insurance – There are many different types of car insurance available in Kenya. Some offer discounts for young drivers, others provide roadside assistance, and some offer better protection. Therefore, it’s important to research the cost of different types of car insurance to find the best one for you.

Shop around – It’s important to shop around for car insurance in Kenya. Some companies may offer a higher price for Third-party property damage coverage, but offer good comprehensive and liability coverage. Therefore, it’s important to research the cost of different types of car insurance to find the best one for you.

Car Insurance in Kenya FAQ’s

How much does car insurance cost in Kenya?

It depends on the company and the type of coverage you want.

When should I buy car insurance in Kenya?

It depends on the company, but most policies require you to have auto insurance within 30 days of getting your car.

How do I report a stolen car?

It’s important to report a stolen car as soon as possible to the police. You should report the theft to your insurance company as well so that they can cancel the policy and report the car as stolen.

Who is responsible if my car is involved in an accident?

It depends on the type of car insurance you have.

What happens if I don’t have the required car insurance in Kenya?

It depends on the type of car insurance you have. If you don’t have car insurance in Kenya, then you risk a hefty fine and a driving ban, or even a jail term of up to six months.

How to Get the Best Rates on Car Insurance in Kenya

Shop around – It’s important to shop around for car insurance in Kenya. Some companies may offer a higher price for Third-party property damage coverage, but offer good comprehensive and liability coverage. Therefore, it’s important to research the cost of different types of car insurance to find the best one for you.

Ask for discounts – It’s important to ask for discounts on your car insurance in Kenya.

Some companies may offer a higher price for Third-party property damage coverage, but offer good comprehensive and liability coverage. Therefore, it’s important to shop around for car insurance quotes.

About Us

Shimin Insurance Agency is licensed to carry out insurance business as an intermediary and has its headquarters at Co-op House along Haile Selassie Street, Nairobi. Through establishing partnerships with various reputable insurance companies in the industry, the Agency has developed a full banquet of innovative insurance products and services that address the insurable needs of our customers and offers these services from across our branches in Kenya.

Our Products

- Insurance Premium Financing

- Motor Vehicle Insurance

- Agriculture Insurance

- Student Accident Cover

- Group Personal Accident

- Domestic Package

- Public Liability

- Product Liability

- Directors Liability

- Professional Indemnity

- Machinery Breakdown

- Fire and Special perils

- Travel Insurance

- Marine Insurance

- Medical Insurance

- Trade Insurance