5 Effective insurance tips when planning for a baby at this time in the world

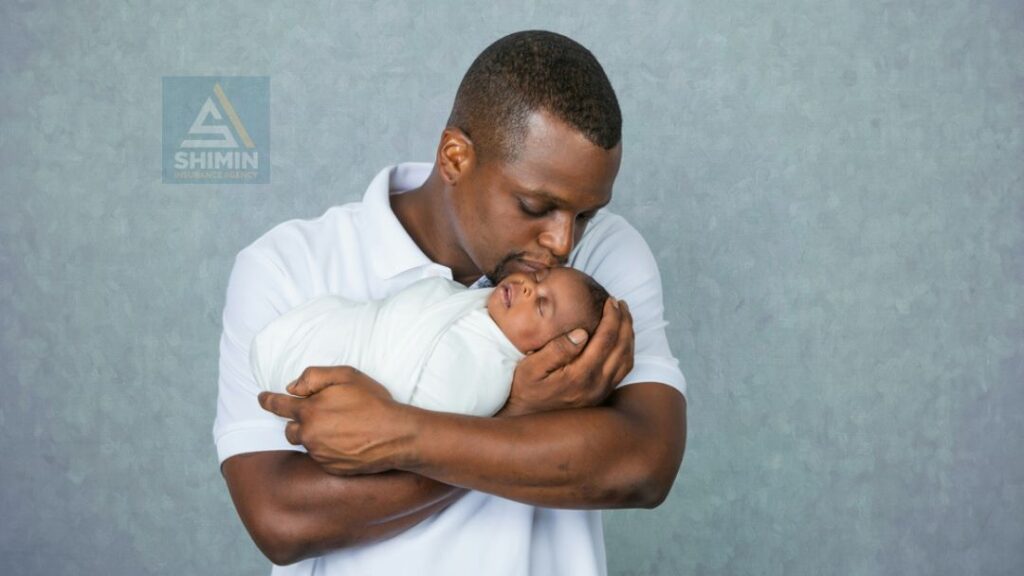

Having a baby is an incredible experience and for many, can bring a lot of joy to their lives. However, preparing for a baby in the current climate can be daunting and stressful. With the worries of a global pandemic and the potential financial implications, it is important to make sure you are adequately prepared for your new arrival. Here are five insurance tips to help you plan for the arrival of a baby at this time in the world. From maternity insurance to health coverage, these insurance tips will ensure you are ready for the unexpected and can provide your family with the protection they need.

Insurance Tips That Help

Review Your Health Insurance Coverage

This is one of the most important insurance tips. Before your baby arrives, it’s important to review your health insurance coverage to make sure it includes maternity care and newborn coverage. Check to see if any limits or exclusions may impact your coverage, and make sure you understand the costs associated with prenatal care, labour and delivery, and postpartum care.

Consider Life Insurance

As a new parent, it’s important to consider life insurance to protect your family’s financial well-being in the event of an unexpected death. Life insurance can provide a lump-sum payment to your beneficiaries to help cover expenses like childcare, mortgage payments, and other bills. Consider purchasing a term life insurance policy that provides coverage for the period when your child is growing up.

Evaluate Disability Insurance

Disability insurance is designed to replace a portion of your income if you become disabled and can no longer work. This type of insurance can be especially important for new parents, as the cost of raising a child can be significant. If you have disability insurance, review your policy to make sure it provides adequate coverage for your family’s needs.

Check Your Homeowner’s Insurance

As your family grows, it’s important to review your homeowner’s insurance policy to make sure it provides adequate coverage for your home and personal property. Consider purchasing additional coverage if you have expensive items like jewelry, artwork, or electronics that may not be fully covered by your policy.

Plan for Child Care Costs

Child care costs can be a significant expense for new parents. If you plan to use a daycare or nanny, it’s important to consider the cost of coverage and whether your employer offers any benefits that may help offset the cost. You may also want to consider a flexible spending account (FSA) to help cover child care expenses.

What is maternity insurance and why is it important?

Maternity insurance is an insurance policy that will help you cover the additional costs associated with having a baby. These costs may include but are not limited to, the cost of having a caesarean section, the cost of hiring a babysitter, the cost of formula and diapers, and any other medical expenses associated with the birth of your baby.

Some maternity plans will also cover the additional costs of bringing the baby home, such as hiring a bassinet or stroller and obtaining supplies like a changing table and crib. You will incur costs that you weren’t expecting when you have a baby. It is important to ensure that you have maternity insurance in place so that you don’t have to incur these expenses out of pocket.

What other types of insurance should you consider?

While maternity insurance is a great way to ensure that you have coverage in place, there are many other factors to consider when trying to find the right type of insurance for you and your family. For example, if you are planning to have more than one child, you may want to consider having a separate child health insurance policy in place.

This can help protect your family financially if one child needs expensive healthcare. Additionally, it is important to make sure that your insurance policy has sufficient coverage. Many policies only cover a set amount per person per year, and as your family grows, this amount is likely to increase significantly. Thus, it is important to plan for your family’s future, and ensure that you have insurance that covers your whole family.

How can you protect your family financially?

One of the best ways to protect your family financially is to ensure that you have enough insurance coverage. The best way to do this is to ensure that your insurance policy has sufficient coverage. To do this, you may want to contact your insurance agent to see what the best options are for you. This will help you determine if you are adequately covered and ensure that you are protected should anything go wrong.

If your policy does not meet your needs, you may be able to get additional coverage by adding riders or endorsements to your policy. Additionally, it is important to make sure that your insurance policy is up to date. Many policies are out-of-date and do not reflect recent changes in the medical field. Thus, it is important to update your policy as often as possible.

How to find the best insurance plan for you

Now that you know what types of insurance you may want to consider, it is time to start looking at specific insurance plans. To do this, it is important to take a step back and think about what you and your family need. This will help you determine which types of insurance you may want to consider. –

- What are your child’s health insurance needs?

- What types of coverage are you looking for in your home and auto insurance coverage?

- How much is the comprehensive insurance coverage?

- What are your other insurance needs?

- How to choose the right type of insurance plan

- What are your needs?

Once you have determined what your needs are, it is time to start looking at specific insurance plans. To get started, it is best to use an online broker that specializes in insurance. With this broker, you can search for specific health insurance plans and compare them side-by-side, making it easier for you to compare and contrast the different plans. It is also important to note that most online brokers will have extensive information regarding the different types of insurance available. Thus, it is best to start with this information, and then choose one that you would like to investigate further based on your needs.

What are the long-term implications of having a baby?

The long-term implications of having a baby are important to consider when preparing for your new arrival. While the joy and anticipation of becoming a parent are incredible, it is important to keep in mind that raising a child is a significant financial and time commitment. Thus, it is important to ensure that you have the resources available to ensure they are adequately covered. As mentioned, one of the best ways to protect your family financially is to ensure that your insurance policy has sufficient coverage. Thus, it is important to first determine what you need, and then ensure that you have it.

What other resources and support are available?

With the arrival of a new loved one, it is important to remember that you are not alone. The best way to ensure you are adequately supported is to reach out to your family, friends and community for support. There are several resources and support available to help you during this challenging time, and it is best to use this support as needed.

Social support – Having a baby is a significant change in one’s life, and can be scary and challenging to deal with on your own. Thus, it is important to surround yourself with people who will support you, as well as remind you that you are loved.

Financial support – With the significant financial cost of raising a child, it is important to remember that you may need more support than you originally anticipated. Thus, it is best to reach out and ask for help.

Health support – The health of a new baby can be challenging and can have significant implications for you and your family. Thus, it is important to make sure that you are adequately covered.

Final thoughts on preparing for a baby in the current world

Having a child is an incredible experience, and is truly one of the greatest gifts you can give to your family. However, it is important to make sure that you are adequately prepared for the arrival of your new arrival. When looking at potential insurance options, it is best to make sure that you are well covered. This way, you won’t have to worry about covering medical expenses out of pocket or incurring other costs that are not covered by your insurance policy.

About Us

Shimin Insurance Agency is licensed to carry out insurance business as an intermediary and has its headquarters at Co-op House along Haile Selassie Street, Nairobi. Through establishing partnerships with various reputable insurance companies in the industry, the Agency has developed a full banquet of innovative insurance products and services that address the insurable needs of our customers and offers these services from across our branches in Kenya.

Our Products

- Insurance Premium Financing

- Motor Vehicle Insurance

- Agriculture Insurance

- Student Accident Cover

- Group Personal Accident

- Domestic Package

- Public Liability

- Product Liability

- Directors Liability

- Professional Indemnity

- Machinery Breakdown

- Fire and Special perils

- Travel Insurance

- Marine Insurance

- Medical Insurance

- Trade Insurance